As the tax landscape continues to evolve, it's essential to stay informed about the latest tax brackets and rates to ensure you're taking advantage of the best possible financial strategies. In this article, we'll delve into the tax brackets and rates for 2025, 2026, and 2027, and provide a comprehensive guide to e-filing your taxes.

Tax Brackets and Rates for 2025

The tax brackets and rates for 2025 are as follows:

10%: $0 to $11,000 (single) or $0 to $22,000 (joint)

12%: $11,001 to $44,725 (single) or $22,001 to $89,450 (joint)

22%: $44,726 to $95,375 (single) or $89,451 to $190,750 (joint)

24%: $95,376 to $182,100 (single) or $190,751 to $364,200 (joint)

32%: $182,101 to $231,250 (single) or $364,201 to $462,500 (joint)

35%: $231,251 to $578,125 (single) or $462,501 to $693,750 (joint)

37%: $578,126 or more (single) or $693,751 or more (joint)

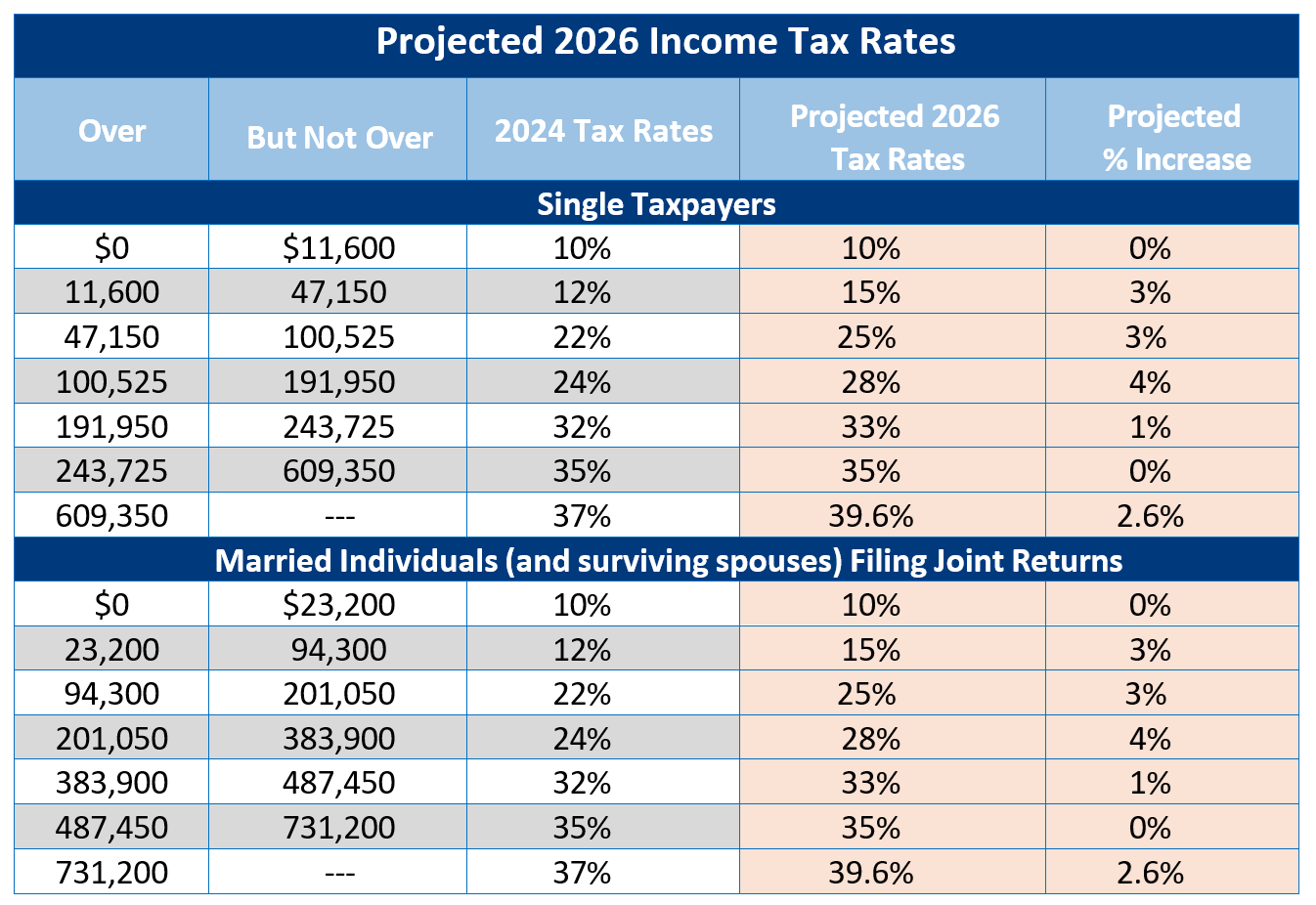

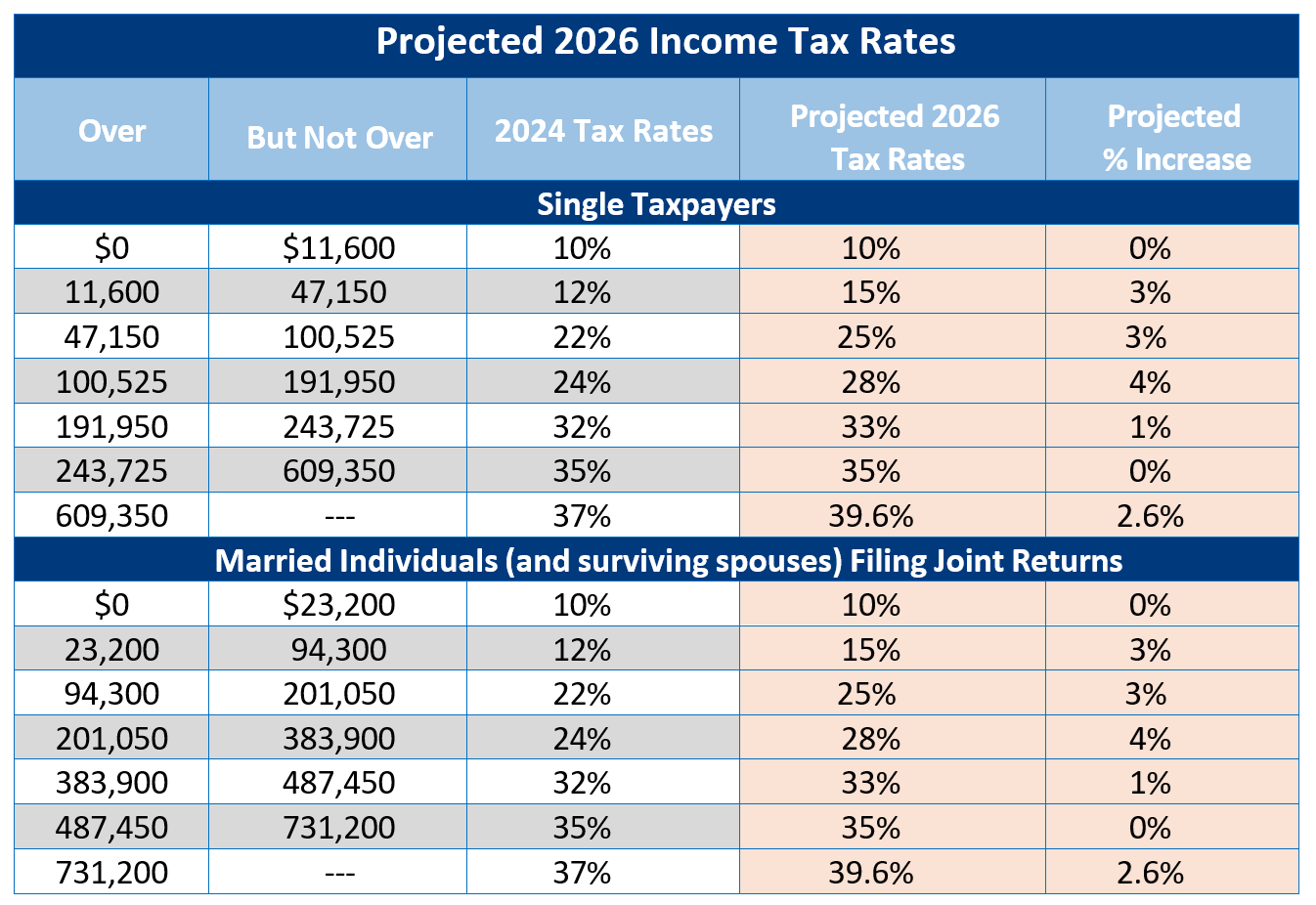

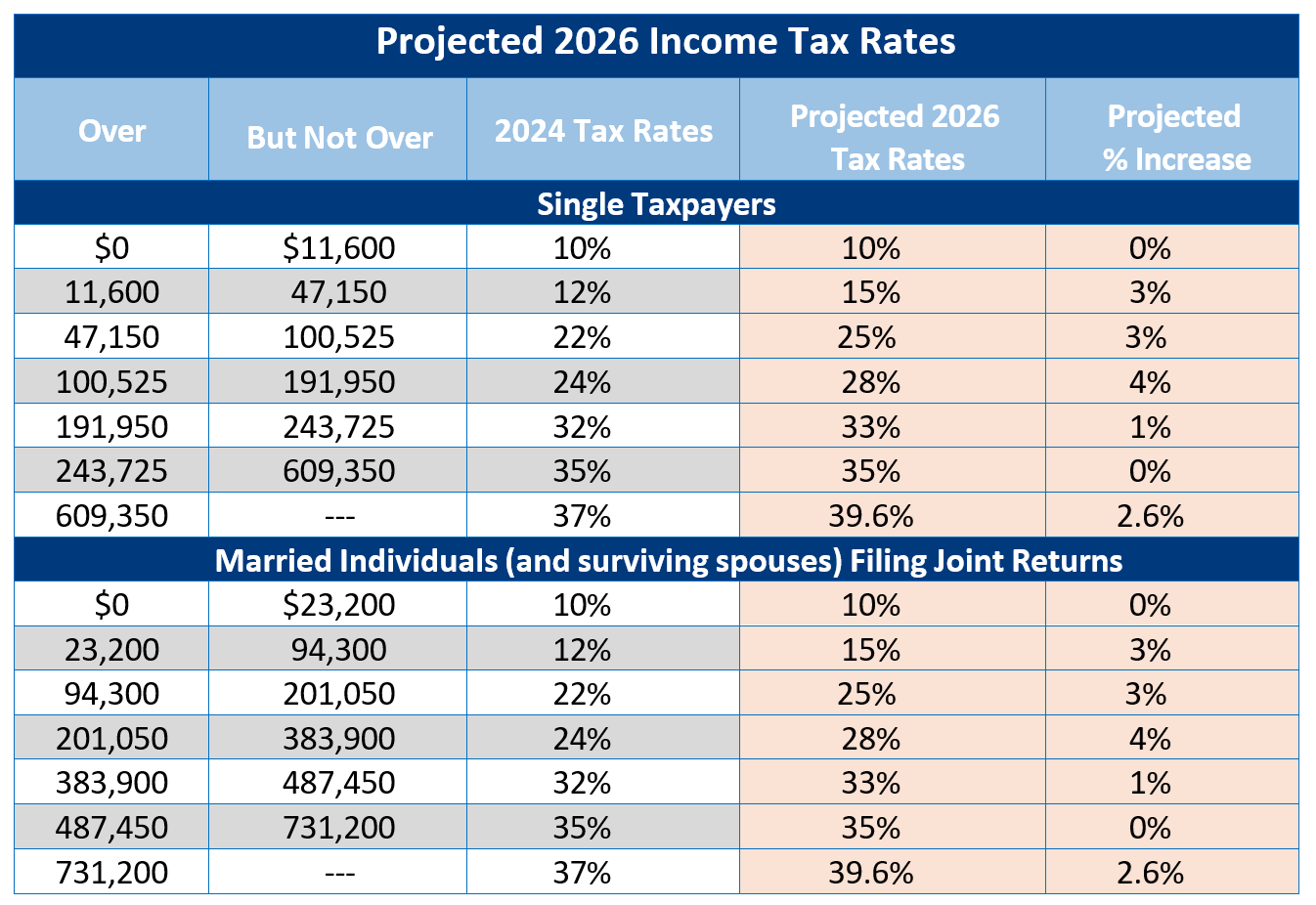

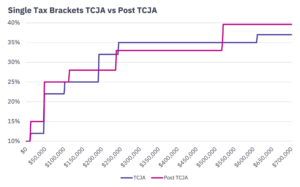

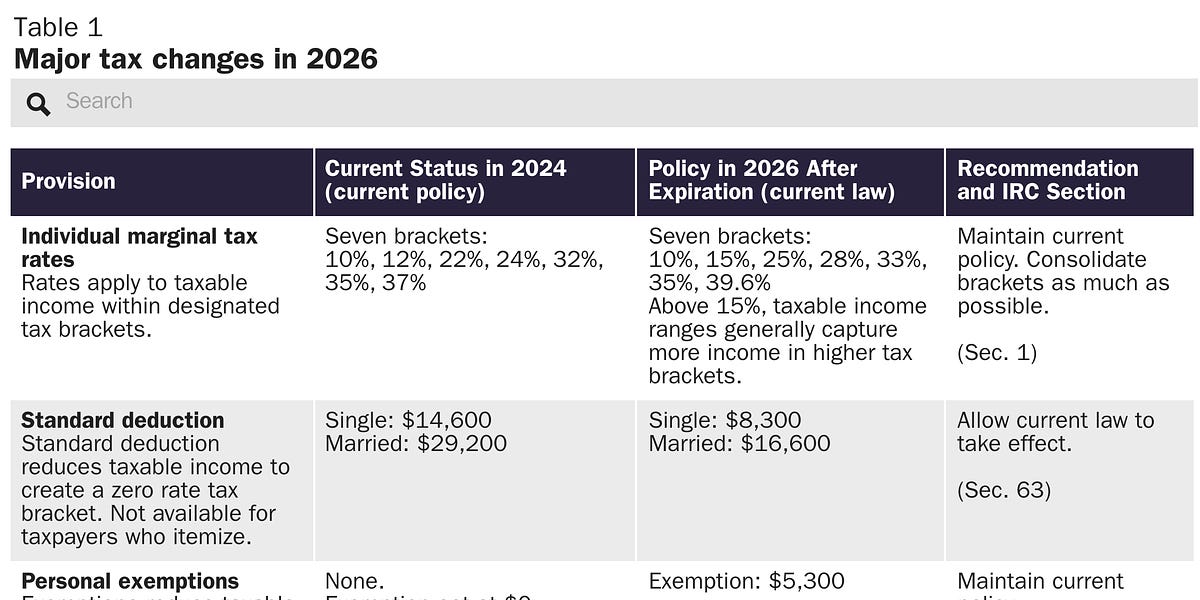

Tax Brackets and Rates for 2026

The tax brackets and rates for 2026 are expected to be:

10%: $0 to $11,200 (single) or $0 to $22,400 (joint)

12%: $11,201 to $45,200 (single) or $22,401 to $90,400 (joint)

22%: $45,201 to $96,300 (single) or $90,401 to $192,600 (joint)

24%: $96,301 to $183,500 (single) or $192,601 to $367,000 (joint)

32%: $183,501 to $233,500 (single) or $367,001 to $467,000 (joint)

35%: $233,501 to $583,300 (single) or $467,001 to $704,300 (joint)

37%: $583,301 or more (single) or $704,301 or more (joint)

Tax Brackets and Rates for 2027

The tax brackets and rates for 2027 are expected to be:

10%: $0 to $11,400 (single) or $0 to $22,800 (joint)

12%: $11,401 to $45,700 (single) or $22,801 to $91,400 (joint)

22%: $45,701 to $97,200 (single) or $91,401 to $194,400 (joint)

24%: $97,201 to $184,900 (single) or $194,401 to $369,400 (joint)

32%: $184,901 to $235,700 (single) or $369,401 to $471,400 (joint)

35%: $235,701 to $589,300 (single) or $471,401 to $711,400 (joint)

37%: $589,301 or more (single) or $711,401 or more (joint)

e-Filing: A Convenient and Secure Way to File Your Taxes

e-Filing is a convenient and secure way to file your taxes, and it's available for the 2025, 2026, and 2027 tax years. With e-Filing, you can:

File your taxes online from the comfort of your own home

Receive instant confirmation of receipt

Get faster refunds

Reduce the risk of errors and audits

To e-File your taxes, simply visit the IRS website or use a reputable tax preparation software. You'll need to provide your personal and financial information, and answer a series of questions to determine your tax liability.

Understanding tax brackets and rates is crucial to making informed financial decisions. By staying up-to-date on the latest tax brackets and rates for 2025, 2026, and 2027, you can optimize your tax strategy and minimize your tax liability. e-Filing is a convenient and secure way to file your taxes, and it's available for all three tax years. Remember to take advantage of the benefits of e-Filing, including faster refunds and reduced risk of errors and audits.

By following the guidelines outlined in this article, you'll be well on your way to navigating the complex world of taxes with confidence. Whether you're a seasoned taxpayer or just starting out, it's essential to stay informed and take control of your financial future. So why wait? Start exploring your tax options today and discover the benefits of e-Filing for yourself.

Note: The tax brackets and rates mentioned in this article are subject to change and may not reflect the actual rates and brackets for the respective tax years. It's always best to consult with a tax professional or the IRS website for the most up-to-date and accurate information.