Table of Contents

- SPY ETF: Guide to the Exchange-Traded Fund SPDR S&P 500 ...

- SPY ETF - Simple stock trading

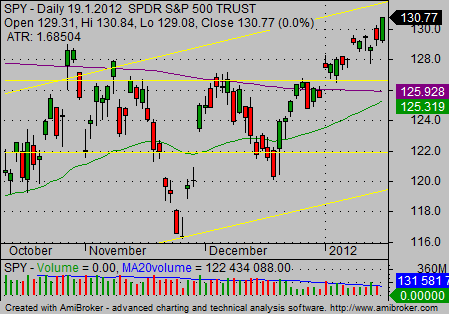

- SPDR S&P 500 ETF (SPY) Stock Chart Technical Analysis

- Elliott Wave View: Why SPY ETF Should See 5 By The End Of 2020

- Top 7 Reasons Why Invest in SPY ETF (SPDR S&P 500 Trust ETF)

- Invertir en SPY: El ETF S&P 500 más importante

- estos son todos los ETFs SPY cual es el mejor para invertir? saga S&P ...

- SPY vs. VOO: Which S&P 500 ETF Is Better? - ETF Focus on TheStreet: ETF ...

- How to Know If the SPY ETF is Right for You - NerdWallet

- $SPY SPDR S&P 500 ETF : r/StockSheets

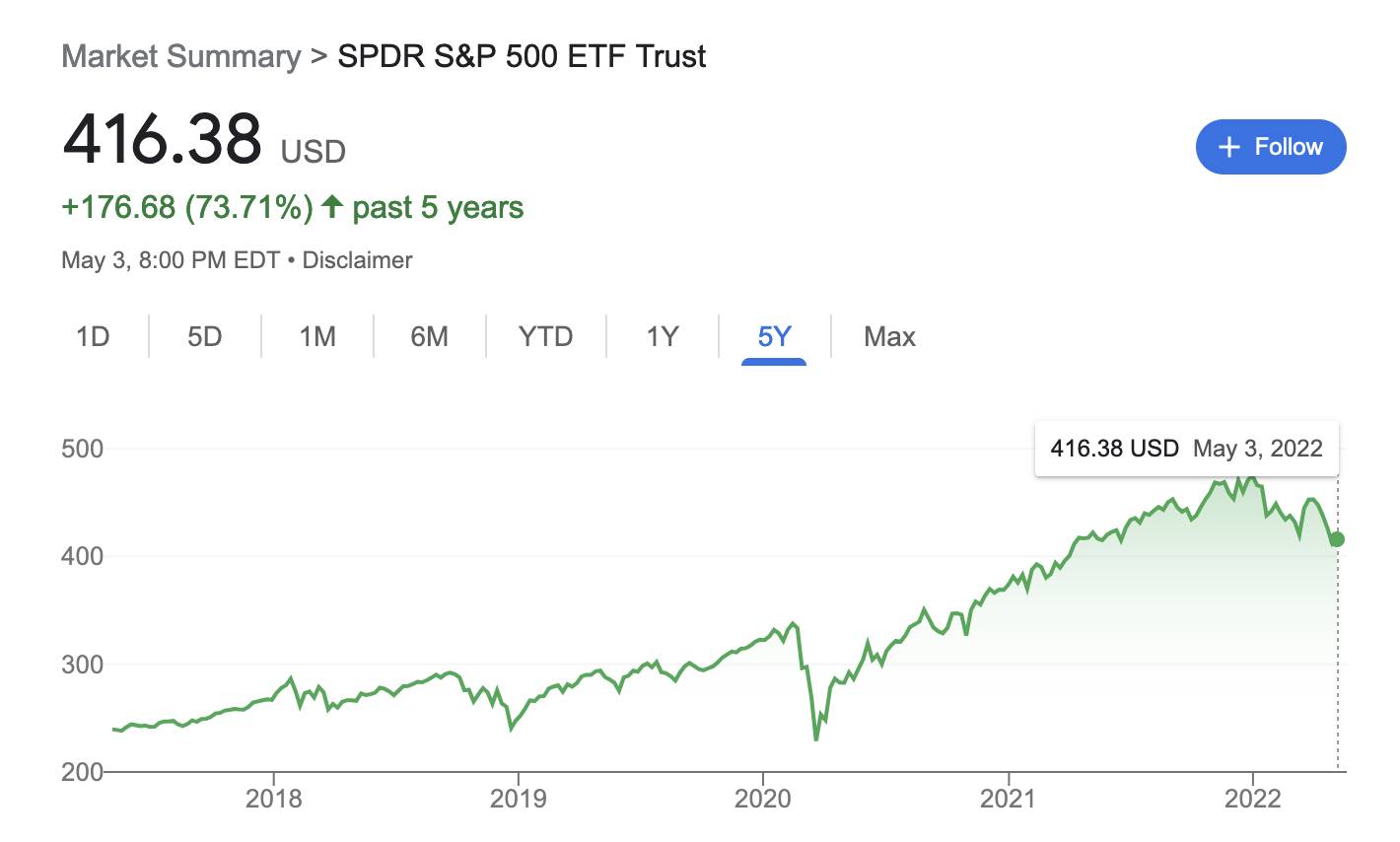

What is the SPDR S&P 500 ETF Trust?

Benefits of Investing in the SPDR S&P 500 ETF Trust

How to Invest in the SPDR S&P 500 ETF Trust

Investing in the SPDR S&P 500 ETF Trust is relatively straightforward. You can buy shares of the SPY through a brokerage account, such as Fidelity, Charles Schwab, or Vanguard. You can also invest in the SPY through a financial advisor or investment manager. It's always a good idea to consult with a financial professional before making any investment decisions. The SPDR S&P 500 ETF Trust is a popular and widely traded ETF that provides investors with a convenient and cost-effective way to gain exposure to the US stock market. With its low costs, diversification benefits, and convenience, the SPY is a valuable addition to any investment portfolio. Whether you're a seasoned investor or just starting out, the SPY is definitely worth considering.For more information on the SPDR S&P 500 ETF Trust, including its current price, holdings, and performance, visit the SPDR S&P 500 ETF Trust website. You can also visit the ETF Database website for more information on ETFs and how to invest in them.

Investing in the stock market involves risks, and there are no guarantees of returns. However, with the SPDR S&P 500 ETF Trust, you can gain exposure to the US stock market with a diversified portfolio of stocks, making it a great option for investors looking to build long-term wealth.

Note: The content provided is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial professional before making any investment decisions.